Bankruptcy filings were on the rise across the United States in 2023, signaling that folks are experiencing more financial distress as interest rates rise and the remnants of Covid-style relief fade into oblivion. And economic challenges in 2023 weren't just limited to individuals either. Businesses also experienced financial hardship and chose to seek relief through filing bankruptcy last year.

In this blog, we'll take a look at the filing trends in Austin for different types of bankruptcy, including Chapter 7s, Chapter 13s, and Chapter 11s. We'll also briefly review the leading factors contributing to the increase in bankruptcy filings.

The Rising Trend of Bankruptcy Filings in 2023

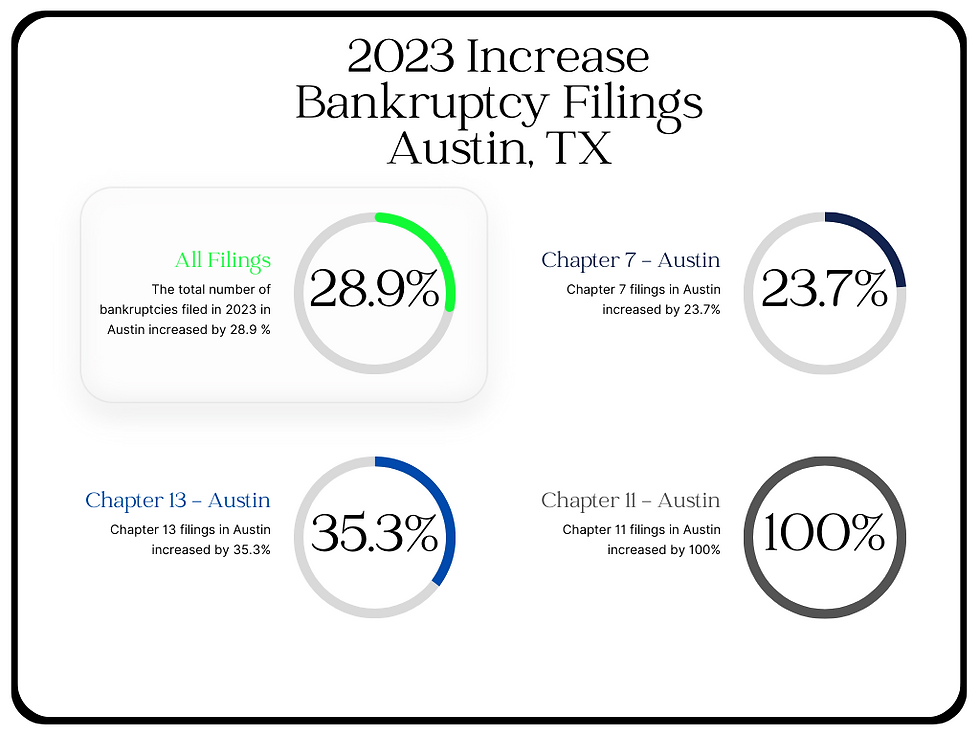

In Austin, the total number of bankruptcies filed for the entire year of 2023 increased by 28.9 percent. The uptick we experienced here is part of a larger trend around the US.

As of October 2023, bankruptcy filings across the US were up by 13 percent according to the United States Courts website. The most recent data states that business filings rose 29.9 percent and Non-business bankruptcy filings rose 12.4 percent between October 1, 2022 and September 30, 2023.

Key Factors Leading to the Increase

The director of the American Bankruptcy Institute, Amy Quackenboss, is on record stating that "[t]he rebound in filings seen this year is a reflection of the challenging economic environment resulting from the evaporation of pandemic responses, including government stimulus, low interest rates and looser lending terms." (November Commercial Chapter 11 Filings Increase 141 Percent over 2022 Propelled by WeWork Bankruptcy) The increased filings tell us that more folks are struggling to make ends meet as this shifting economic environment.

Other observers are noting that the increase is more of a "return to normal" following the pandemic, which came on the heels of more than a decade of easy money in the aftermath of the Great Recession.

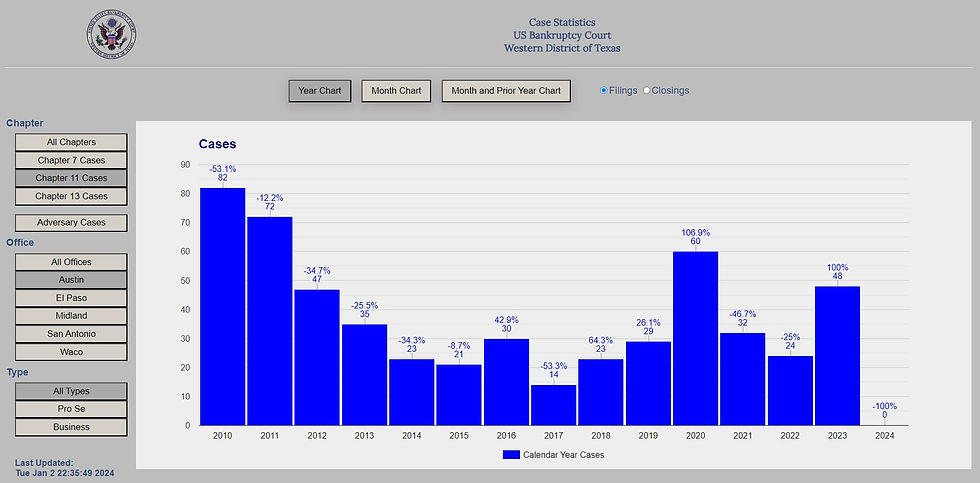

Historical filing data seem to support this "return to normal" hypothesis.

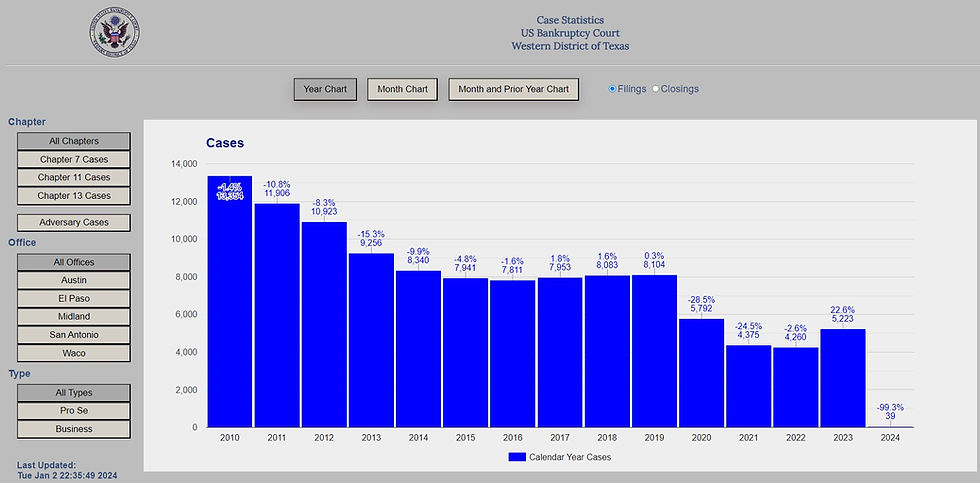

Looking at the filing data for the US Bankruptcy Court for the Western District of Texas, we see that there were 13,354 bankruptcy filings in 2010. That number fell to 8,340 by 2014, and it remained in that range until Covid swept the globe in 2020.

However, it is worth pointing out that the total number of filings consistently trended downward from 2010 until 2016, yet consistently trended upwards from 2016 through 2019.

The historical context suggests that maybe we're not stuck in a doom-and-gloom death cycle that's certainly headed for recession, as some are suggesting. Instead, it's likely the case that bankruptcy filings were artificially low for several years due to stimulus relief and cheap money (a.k.a. low interest rates).

How Many Chapter 7 Bankruptcies Were Filed in 2023?

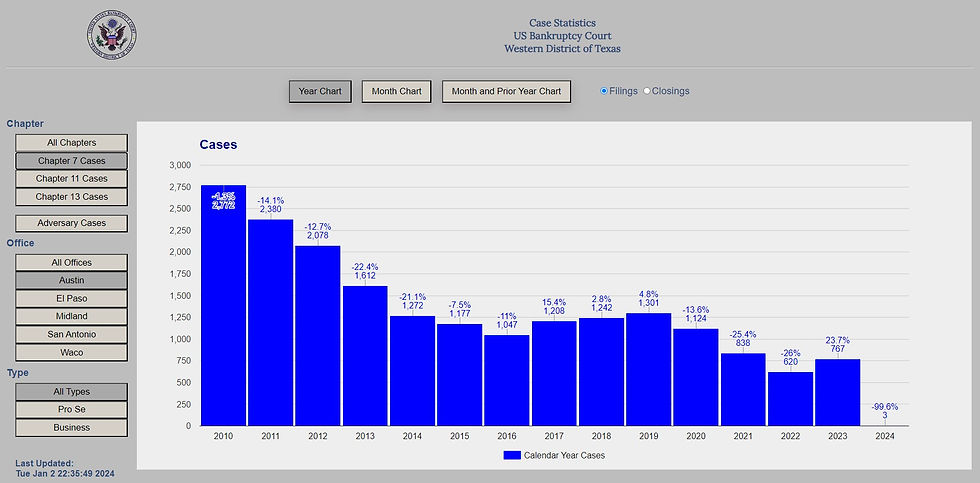

There were 767 Chapter 7 bankruptcy filings in 2023 in the the Austin Division of the US Bankruptcy Court for the Western District of Texas. That's an increase of 23.7 percent over 2022, but still well short of pre-pandemic levels.

Remembering, however, that we may be witnessing a "return to normal" scenario, it's helpful to compare the total number of bankruptcies filed in 2023 to some historical filing statistics.

Pre-pandemic Chapter 7 bankruptcy filing trends in Austin from 2010 to 2019 reveal that there was a period of stability from roughly 2016 and 2019. During this period of stability, we saw the fewest number in 2016 with a total of 1,047 and we saw the most filings in 2019 with a total of 1,301.

Comparing the total number of Chapter 7s filed in the Austin Division in 2023 to this historical data, we see that there were 26.7 percent fewer Chapter 7 bankruptcy filings in 2023 compared to the previous "low point" of 2016, and there were 41 percent fewer Chapter 7 bankruptcy filings in 2023 compared to the previous "high point" of 2019. That means that there were roughly 2 Chapter 7 bankruptcies filed in 2023 for every 3 that were filed in a given year between 2016 and 2019.

Increase in Chapter 13 Bankruptcy Filings in 2023

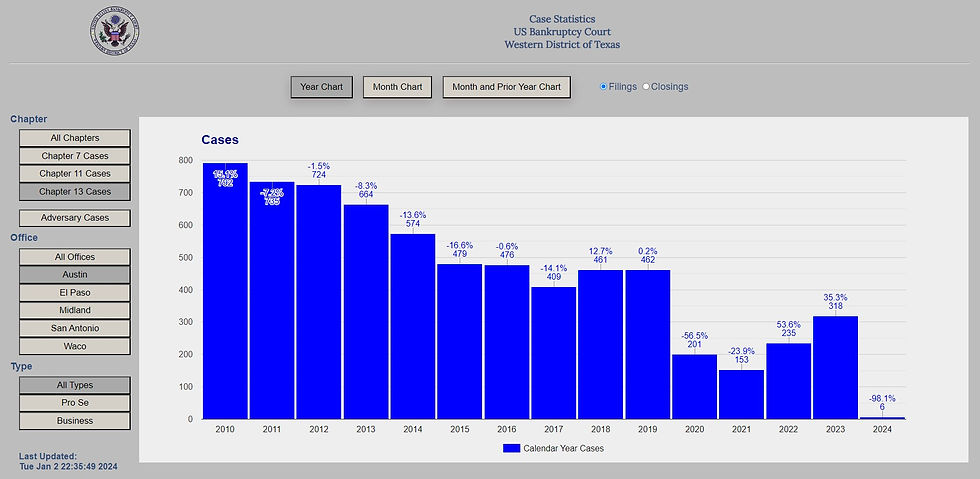

Chapter 13 bankruptcy filings in Austin also increased and the data tell a similar story to the Chapter 7 bankruptcy data.

In total, Chapter 13 bankruptcy filings in the Austin Division were up 35.3 percent over 2022.

However, comparing the total number of Chapter 13 bankruptcy filings in the Austin Division in 2023 to this historical data, we see that there were 22.24 percent fewer Chapter 13 bankruptcy filings in 2023 compared to the previous "low point" of 2017, and there were 31.16 percent fewer Chapter 13 bankruptcy filings in 2023 compared to the previous "high point" of 2019. That means that there were roughly 3 Chapter 13 bankruptcies filed in 2023 for every 4 that were filed in a given year between 2016 and 2019.

Chapter 11 Bankruptcies in Austin, Texas

Bucking the "return to normal" narrative, the Chapter 11 bankruptcy statistics for the Austin Division show that there was a dramatic increase in Chapter 11s filed in 2023. What's strange about the increase in Chapter 11 bankruptcies filed in 2023 though is that filings under this chapter of the bankruptcy code are actually higher than pre-pandemic levels, and quite a bit higher at that.

The reason for this increase seems to be related to higher interest rates and increased costs of goods and services due to inflation. However, some observers have suggested that the Covid style relief provided a lifeline to businesses that would've failed despite the pandemic, and now that the relief has dried up so too are the businesses who relied on the support.

A related point to address is the suggestion that personal bankruptcy filings (7s and 13s) will increase due to the increase in Chapter 11 filings. No data seem to support this notion that an increase in 1 type of bankruptcy is the cause of an increase in filings for another type of bankruptcy, and that's not what we're suggesting here.

Key Takeaways from the Rise in Bankruptcy Filings for 2023

The biggest takeaway from the increased bankruptcy filings in Austin in 2023 is that we still haven't returned to pre-pandemic levels for bankruptcy filings, despite the increased number of filings.

Yes there were more bankruptcy filings in 2023 than in 2022, but there is still 1 less bankruptcy filed for every 4 that were filed in 2016 and there is 1 less bankruptcy filed for every 2.5 that were filed in 2020.

Another takeaway is that while we'll probably continue seeing an increase in the number of filings in 2024. The total number of filings have been artificially low over the last few years due to a variety of factors that have all been eliminated, and now there doesn't seem to be any reason to believe that a return to normal won't occur.

Conclusion

Bankruptcy filings increased in 2023, but with the exceptions of Chapter 11 filings they haven't returned to pre-pandemic levels. This may mean that further increases are ahead as more people see a decrease in disposable income, the return of student loans, and an increase in interest on their credit cards, car loans, and personal loans. We should remember in 2024, however, that as we see even greater increases in filings it's not necessarily a sign of a collapsing economy or something else, it's just a return to normal in the bankruptcy world.

Bankruptcy is often a last resort for folks struggling with overwhelming debt who want to get their financial affairs in order and retake control of their lives. Anyone considering the bankruptcy process to finally achieve a fresh start should speak to a bankruptcy lawyer in their area. A bankruptcy attorney can answer questions and help you determine whether bankruptcy is a good option for you.

Comments